alinma bank orchestrates a multi-app strategy with full control via Pushwoosh API and zero high-load issues

alinma bank, one of Saudi Arabia’s leading financial institutions, manages a complex ecosystem of multiple banking apps — all powered by Pushwoosh’s API-driven messaging infrastructure. With millions of messages delivered daily across transactional and marketing campaigns, the bank maintains enterprise-grade reliability while retaining full control over segmentation, deep linking, and security.

About alinma bank

alinma bank is a leading Saudi Arabian financial institution serving millions of customers across retail, SME, and corporate banking segments. Since its establishment, alinma bank has built a reputation for innovation and customer-centric service, positioning itself at the forefront of the Kingdom’s digital banking transformation.

alinma bank operates a comprehensive digital ecosystem that includes mobile banking apps, youth-focused financial products, investment platforms, digital wallets, and enterprise solutions—all designed to deliver fast, secure, and personalized banking experiences.

To manage customer communications across this multi-app portfolio at scale, alinma bank has partnered with Pushwoosh since 2017, leveraging its API-driven messaging infrastructure to handle millions of transactional and marketing messages with enterprise-grade reliability.

Challenges

alinma bank operates one of the most complex messaging ecosystems in the financial sector, managing multiple apps under a single account. To maintain its sophisticated digital banking operation, the bank needed a customer engagement platform that could handle:

- Highly transactional environment: Most communications are transactional in nature, requiring fast, reliable message delivery at scale. Any delays or failures could directly impact customer experience and trust in critical banking operations.

- Custom user management architecture: Rather than relying on standard UserIDs, alinma bank maintains its own internal user database and manages users via Pushwoosh Tags. The bank also implements dynamic, sophisticated deep links and custom integrations to maintain security and operational control across all apps.

- Internally-driven segmentation: All marketing segments are defined within alinma bank’s own systems based on behavioral and lifecycle events (e.g., users likely to accept a credit offer or customers who have repaid their loans and are now ready for new offers). Segments are then fed into Pushwoosh for targeted messaging.

- High-volume, multi-app management: The bank operates multiple apps and regularly sends campaigns to hundreds of thousands of users. Among other things, this requires daily CSV imports for the youth app. The most efficient approach in this case is to manage all operations under a single account, and this is exactly what the team does in Pushwoosh — something they couldn’t do with many other platforms.

- Performance under load: The bank needed increased requests per second (RPS) capacity to handle high-volume traffic without compromising delivery speed, especially during peak transactional periods.

To face these challenges successfully, alinma bank’s team chose Pushwoosh as a powerful messaging engine that executes their strategy with precision and control.

Solution: API-first messaging engine built for enterprise scale

Pushwoosh integrated smoothly into our existing infrastructure with minimal disruption. The API was straightforward to implement, and we were able to connect it to our proprietary systems quickly. Even as we’ve added more apps and increased our message volume over the years, scaling has never been an issue.

Pushwoosh’s flexible, API-driven architecture proved ideal for alinma bank’s sophisticated requirements, serving as a reliable delivery engine while the bank maintains full control over strategy and segmentation.

- Seamless integration with internal systems: The bank connects Pushwoosh directly to their proprietary user database, managing all users via tags rather than standard UserIDs. This approach allows the team to maintain complete control over customer data and segmentation rules.

- Dynamic deep linking that routes users to specific screens across different applications — all executed through Pushwoosh’s API with complete reliability.

- High-volume campaign execution: Daily CSV imports for the youth app and bulk campaigns to hundreds of thousands of users are processed efficiently, with no manual intervention required.

- Increased RPS capacity for peak performance: Pushwoosh scaled its infrastructure to meet alinma bank’s specific throughput requirements, ensuring instant delivery even during the busiest transactional periods.

- Custom segment execution: Segments created in alinma bank’s internal analytics platform are pushed to Pushwoosh for targeted message delivery, combining the bank’s sophisticated behavioral modeling with Pushwoosh’s reliable delivery infrastructure.

This approach allows alinma bank to focus on customer insights and strategic decision-making, while Pushwoosh provides the robust delivery platform they need.

We don’t use Pushwoosh like a typical customer — we manage everything through our own systems and use the platform purely as a delivery engine. The fact that Pushwoosh supports this level of customization while maintaining enterprise-grade performance is exactly why we chose it and continue to rely on it.

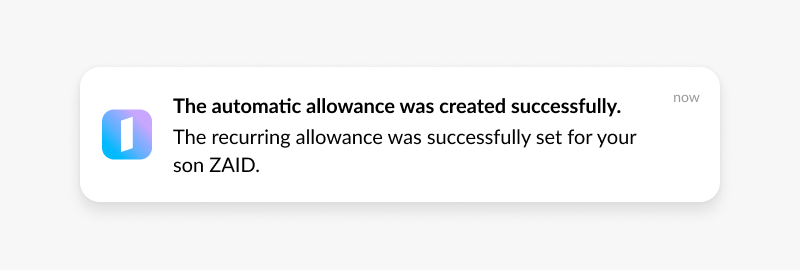

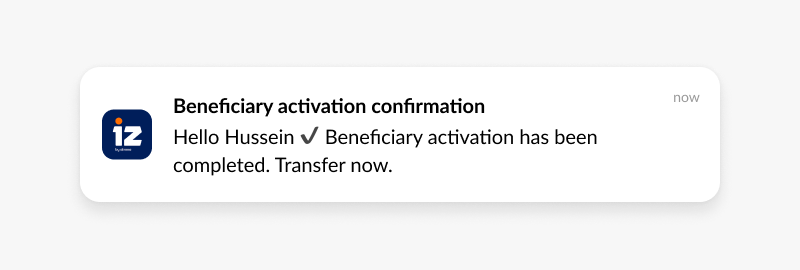

Examples: Effective push notifications from alinma bank apps

All push notifications below are translated from Arabic.

Transactional notifications

- Transaction confirmation

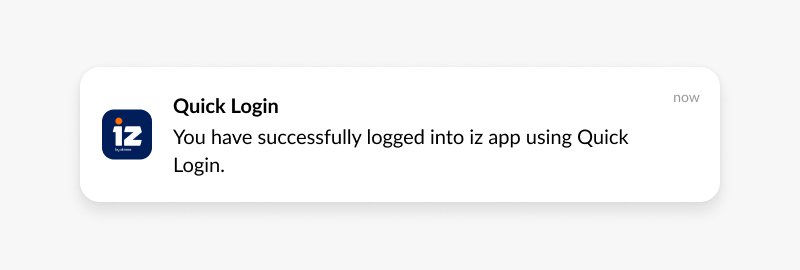

- Login alert

- Security alert

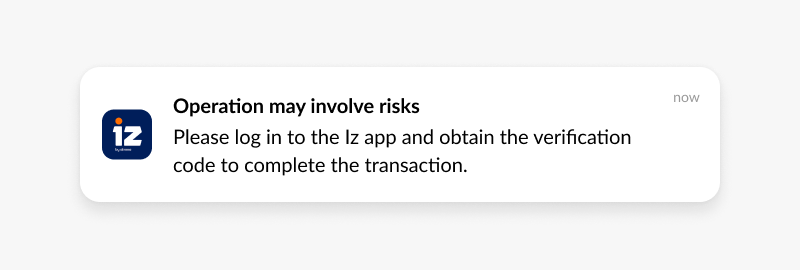

- Market update for investors

Again, note the personalized details: specific stock number, target price, actual price, and timestamp.

Marketing notifications

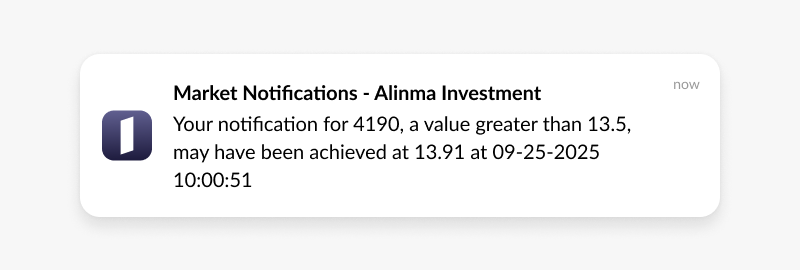

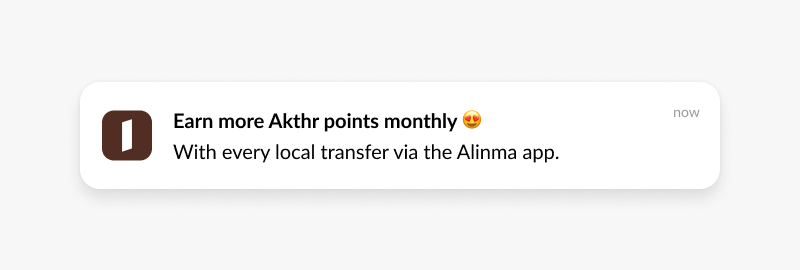

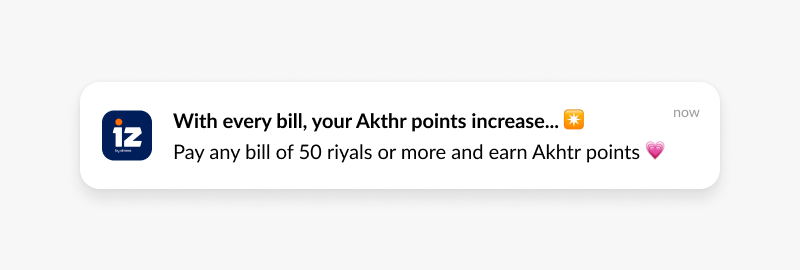

- Promote product usage

- New banking / financial product promo

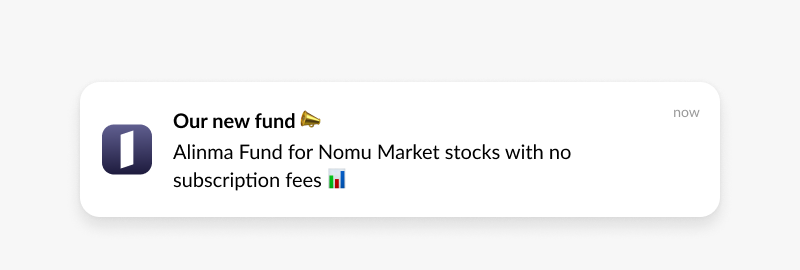

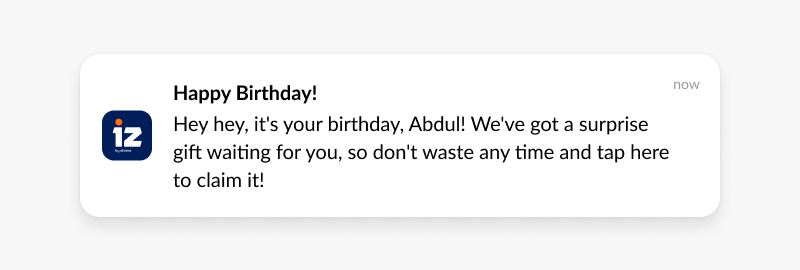

- Birthday offer

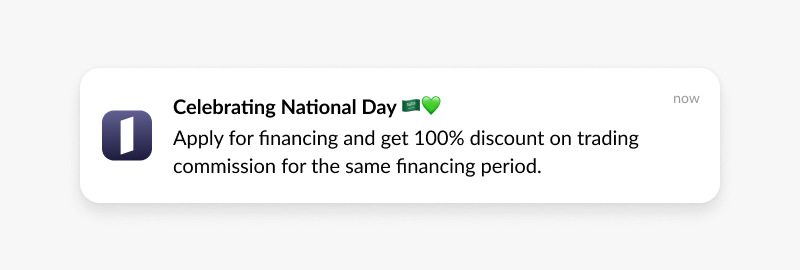

- Seasonal promo

alinma bank ran coordinated promotional campaigns for Saudi National Day across multiple apps:

Behavior-triggered and lifecycle notifications

- New user onboarding & activation

- Referrals

Here, alinma bank’s youth app drives user acquisition through referral incentives:

A successful referral is followed up with an enticing reward:

Results

- Zero performance issues under high load: Millions of messages are delivered daily across multiple apps with no complaints about delivery speed or reliability, which is critical for maintaining customer trust in time-sensitive banking communications.

- Seamless multi-app orchestration: Managing several banking apps under a single Pushwoosh account — a capability few platforms can offer at this scale — has streamlined operations and reduced system complexity.

- Eight years of partnership stability: After eight years of continuous use, alinma bank continues to rely on Pushwoosh as its scalable, dependable messaging engine, enabling its digital-first banking strategy across multiple apps and customer segments.

We’ve been with Pushwoosh since 2017, and that longevity speaks for itself. The platform just works, consistently and reliably. As our digital banking strategy has evolved and grown more complex over the years, Pushwoosh has scaled right alongside us without missing a beat.

Ready to power your multi-app strategy with enterprise-grade messaging? Discover how Pushwoosh’s flexible API and robust infrastructure can support your most demanding use cases. Contact us to learn more.