Fintech app growth in 2025: A full-funnel strategy [Data-backed]

Finance apps operate in a high-stakes environment: low organic visibility, high CPIs, trust-sensitive onboarding, and strict user expectations. To move from an app install to a positive ROI, a full-funnel strategy is required.

This playbook, a joint effort from ASO leader AppTweak and engagement expert Pushwoosh, breaks down the key opportunities across acquisition, activation, and retention, with concrete actions teams can take now to drive their fintech app growth in 2025.

User acquisition: Turn high costs into high conversion

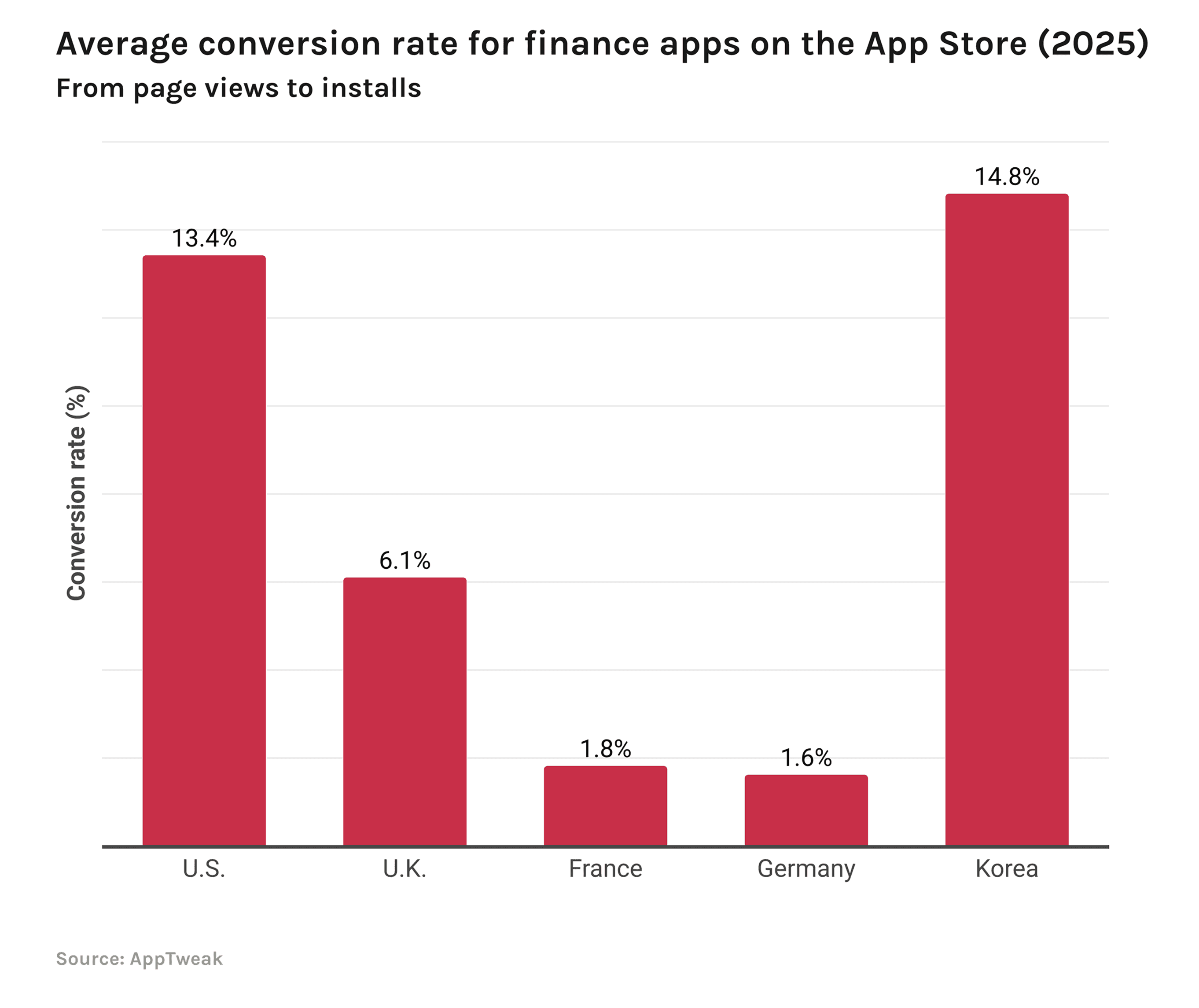

AppTweak’s 2025 Finance app insights report reveals a massive gap in organic conversion rates, from highs of 14.8% in Korea and 13.4% in the U.S. to lows of 1.8% in France and 1.6% in Germany.

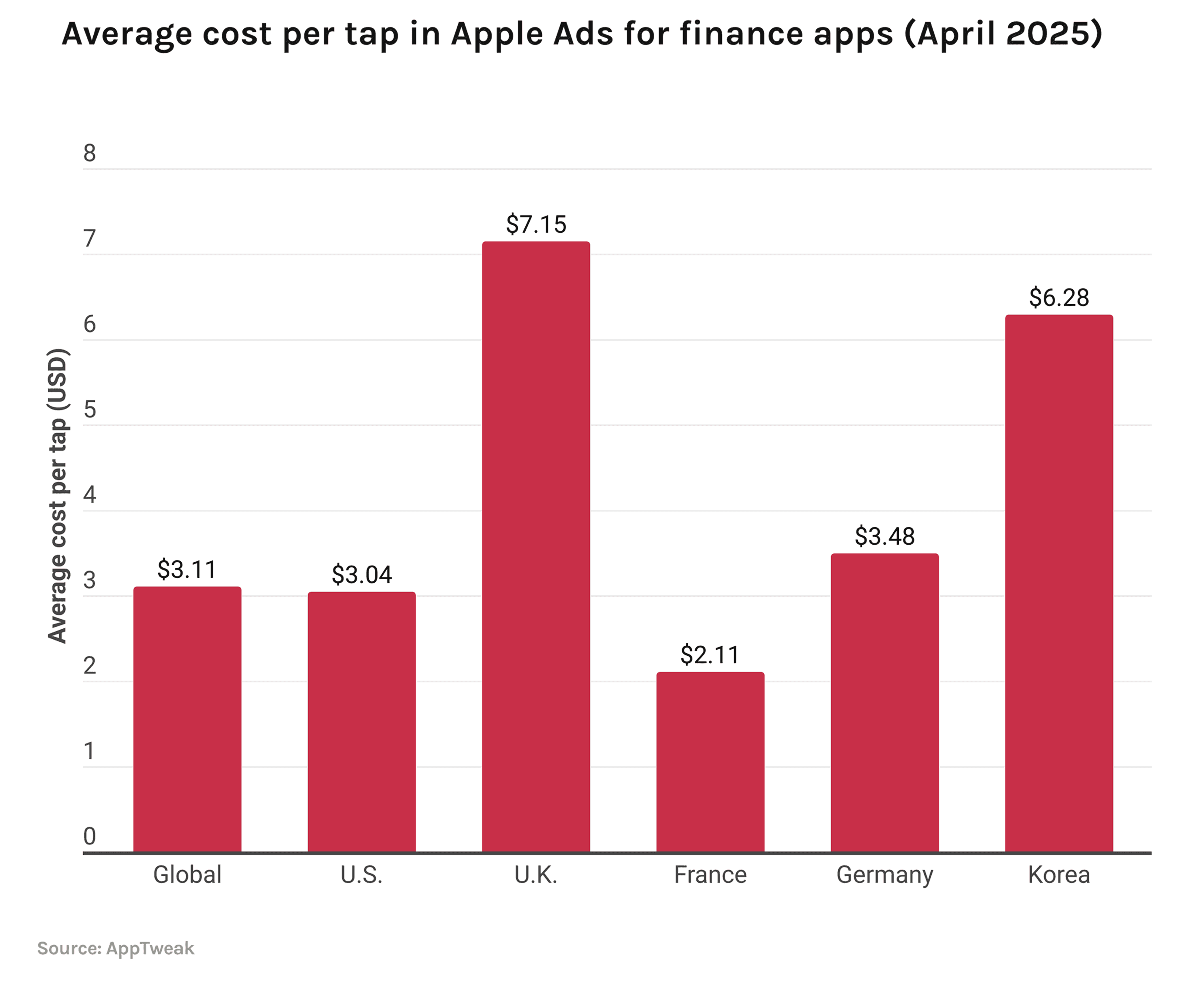

This disparity is especially critical in markets where paid acquisition is costly. Finance apps in the U.K. and Korea, the two countries with high organic conversion potential, are also facing some of the highest cost per tap rates globally at $7.15 and $6.28, respectively, which is over twice the global CPT.

To maximize ROI in these high-stakes markets, leading apps are leaning into conversion optimization levers that work across both paid and owned acquisition channels. Here’s where we suggest you start.

Launch custom product pages (CPPs)

Custom product pages let you tailor your App Store page to specific audiences. They’re especially powerful when used in Apple Ads, or linked from email, web, or social campaigns. AppTweak recommends creating a CPP for each user intents or keyword themes, helping to boost relevance and conversion.

AppTweak data reveals that custom product pages can increase conversion by almost 6%, yet only 4 of the top 10 finance apps in the U.S. use them, making CPPs an underutilized growth lever.

Update app store creatives

Only 50% of the top 100 U.S. finance apps have updated screenshots in the past 90 days.

Fresh screenshots are a great way to get ahead of your competitors. Fintech apps that regularly refresh their screenshots not only remain current but can also test new messaging and visuals to improve conversion rates via iteration.

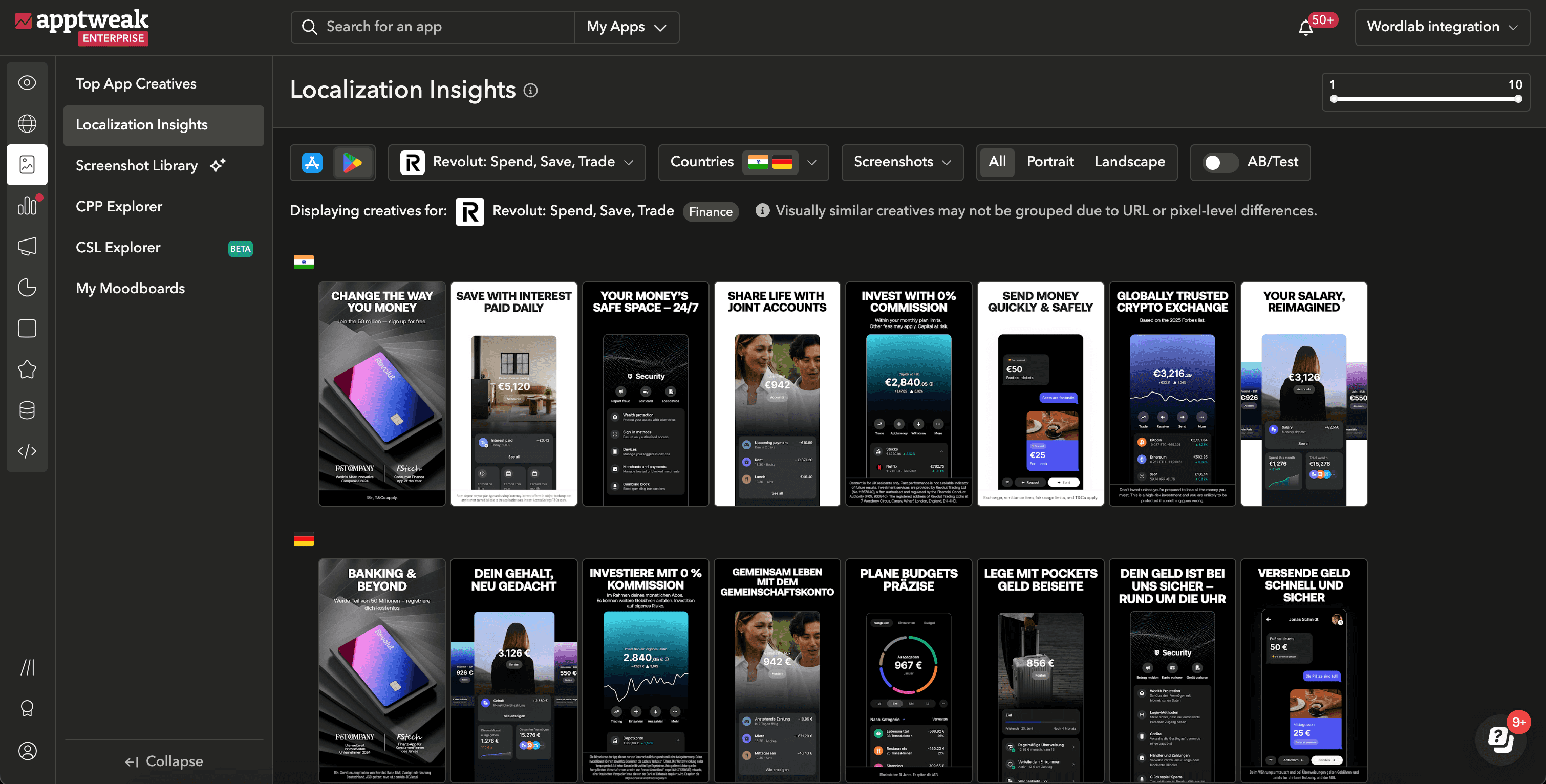

Localize for cultural values

App localization is a powerful yet underused lever for finance apps expanding into new markets. It goes beyond translation. By adapting your store listing messaging, visuals, metadata, and keywords to local cultures and their values, you build trust and improve conversion.

In finance, where credibility is everything, even small localization tweaks can make a big impact. For example, in Germany, fintech app users expect all content to be localized and to have a professional design. Meanwhile, Indian finance app users value security and savings, so your messaging should reflect this.

To get it right, prioritize high-opportunity markets and ensure your in-app experience aligns with your localized store presence. Consider a third-party tool like AppTweak that lets you see what your competitors are doing in other regions for their CPPs and screenshots.

Explore lower-cost markets for cost-efficient growth

Take a moment to observe the average CPTs in other markets you’re interested in expanding into and consider if perhaps a lower-cost one might help your brand grow without depleting your budget.

For example, France has an average CPT of $2.11 for finance apps. Therefore, if your market research shows that the country would be promising for your app, localize your metadata and creatives for smarter scaling.

Activation: Leverage the golden onboarding time

After paying up to $7.15 for a single tap, ensuring user activation isn’t just a goal—it’s an economic necessity.

Yet, only 13.55% of users open a finance app again within 24 hours of install, according to Pushwoosh retention benchmarks. This means nearly 87% of your expensive acquisitions are at immediate risk of churning before you’ve had a chance to demonstrate your core features.

Triggered personalized in-app onboarding

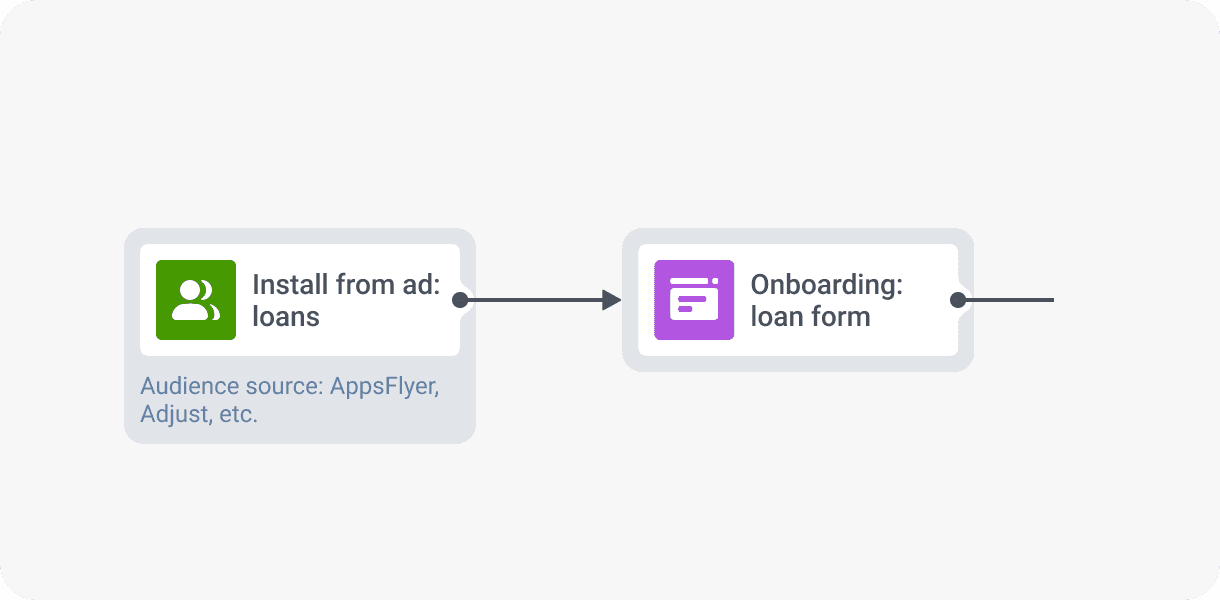

Finance app users often arrive with a clear intent: investing, budgeting, borrowing, or sending money abroad. You can match these intents by creating tailored onboarding flows triggered by acquisition context (campaign, keyword, audience segment).

For example:

💰 A user who arrived from an ad for “budgeting tools” should receive an in-app message that guides them directly to your budgeting feature, not your investment options.

💵 A user acquired through a campaign promoting “low-interest loans” should be guided immediately toward starting a loan application.

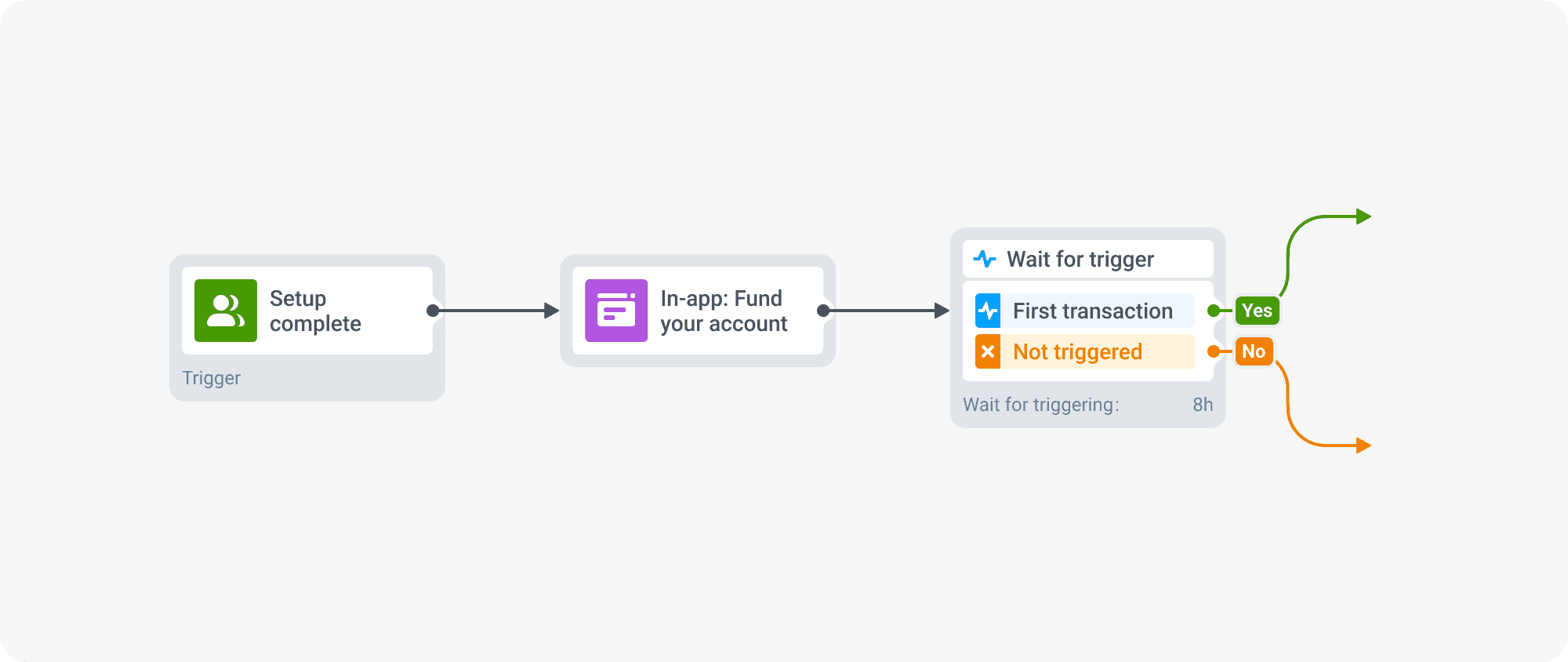

Drive activation actions with timely nudges

The second part of a successful activation strategy is prompting key actions. Don’t wait for users to explore; guide them to the next logical step with clear, benefit-driven nudges. Push notifications are the perfect channel for this.

Once a user has completed the initial setup, use automated push notifications to encourage high-value actions that signal true activation, such as:

- First login: “Welcome back! Your personalized dashboard is ready. Take a look.”

- Verification: “Just one step left to secure your account. Add your verification details now.”

- First transaction: “Your account is ready! Take the final step and fund it today to earn a $10 bonus.”

These timely nudges dramatically increase the likelihood that a user will complete the activation milestones that correlate with long-term retention.

Retention: Build engagement & loyalty with behavioral automation

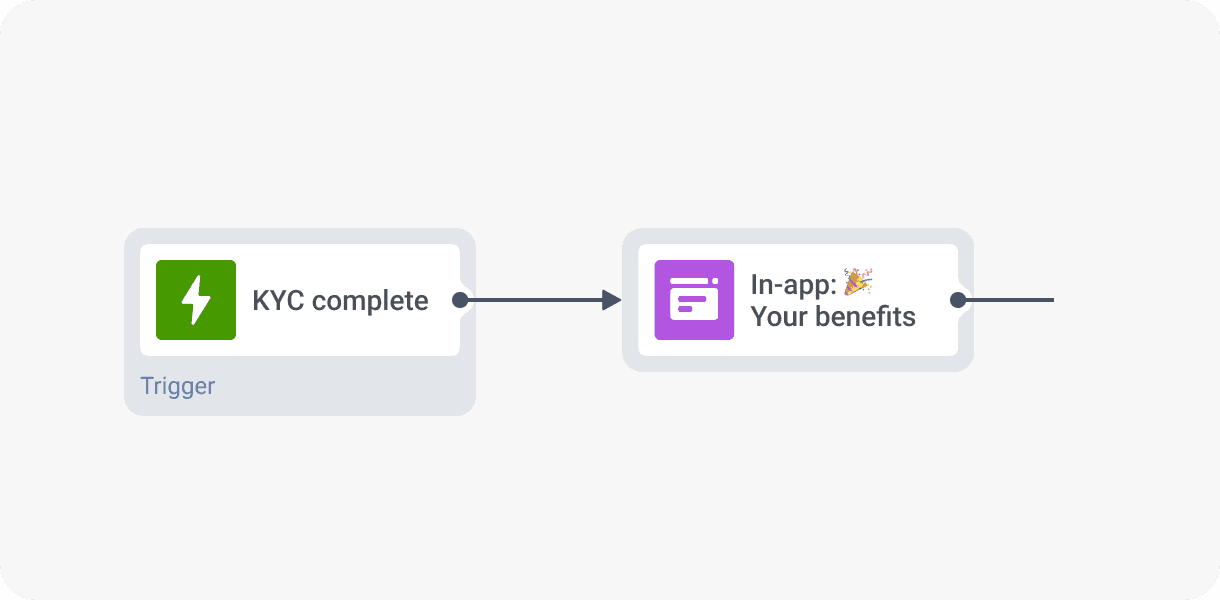

To retain fintech app users in the long term, create event-driven communication around meaningful user milestones and risk points.

By tracking behavioral data, you can identify high-value moments and reinforce them with the right messages. For example:

- KYC complete: Trigger a celebratory in-app message that outlines the next steps and benefits.

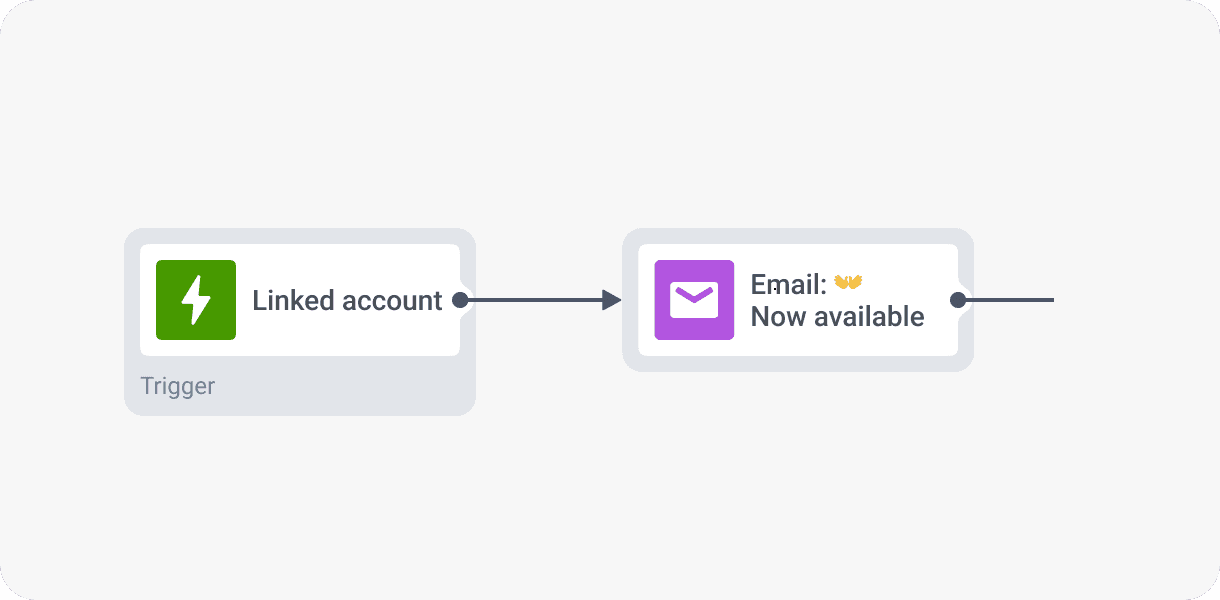

- Linked account: Send an email suggesting the features now available to explore.

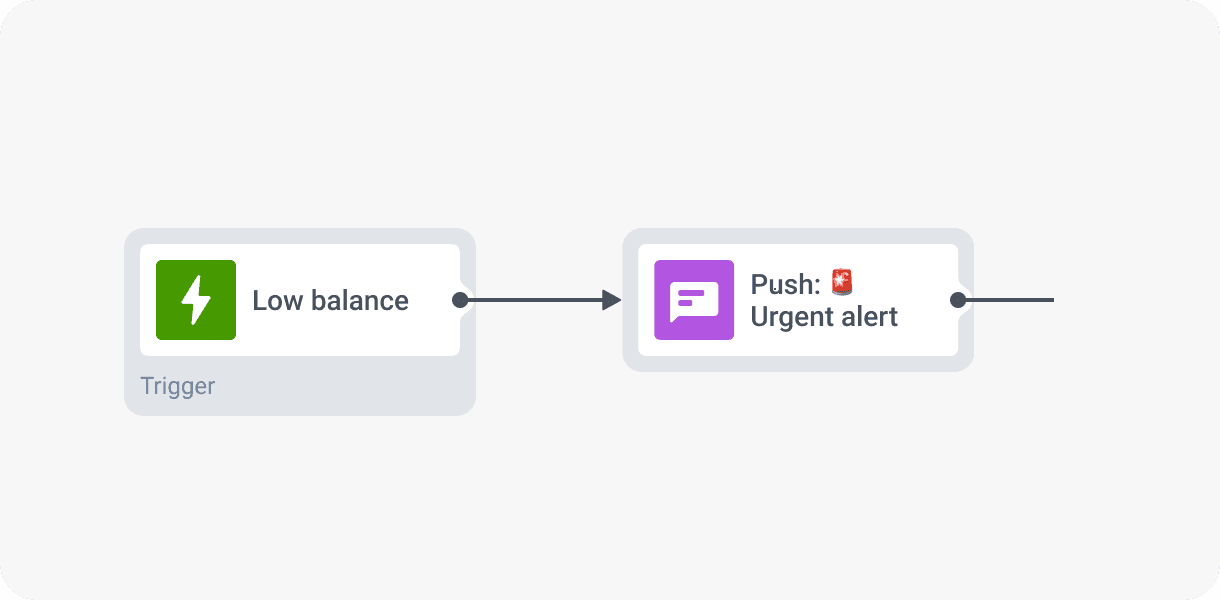

- Missed payment or low balance: Send urgent push alerts to prevent fees or service interruptions.

Use push notifications, in-app messages, email, and WhatsApp strategically, depending on the urgency and required action.

Close the loop: Let retention data fuel smarter acquisition

With Pushwoosh, you can:

- Identify your best acquisition channels, campaigns, keywords, or CPPs that drive the highest-LTV users — not just the most installs. This allows you to double down on what works and cut inefficient spend.

- Track cohort-level behavior (e.g., conversion to first transaction, churn rate) and match this data to AppTweak’s keyword performance reports.

- Create powerful segments for re-engagement.

With AppTweak, finance apps can prove impact across ASO and Apple Ads:

From uncovering high-intent keywords to automating Apple Ads campaigns, optimizing creatives, and replying to reviews at scale, AppTweak provides brands like PayPal, Monzo, Binance, and more with all the app store marketing insights they need for growth.

Keep an eye on what your competitors are up to in the app stores. Monitor metadata updates and A/B tests, view in-app events, and track custom product pages. Set real-time alerts so you can act quickly and outsmart the competition.

👉 Get more insights on finance apps’ ASO performance — download AppTweak’s report.

🚀 To improve your fintech onboarding and retention funnel, book a Pushwoosh demo.

![Fintech app growth in 2025: A full-funnel strategy [Data-backed]](/content/images/2025/08/Fintech app growth - Pushwoosh blog.png)