40% revenue growth in 90 days with autonomous ManyMoney AI: Case study

Is it even possible to get 40% revenue growth in 90 days from mobile engagement campaigns?

Most marketing teams would say no, especially if they’re already running competent campaigns. If you’ve moved past broadcast blasts, implemented segmentation, added personalization, and are running A/B tests, what’s left to optimize? Another 5–10% lift? Maybe. But 40%?

Here’s the reality: It is possible if you have:

✅ A mature mobile app (10k+ MAU) with solid user engagement

✅ Robust event tracking, capturing key user behaviors

✅ “Okay” campaigns already in place — basic segmentation, some personalization, scheduled sends

✅ A team that knows what they’re doing (you’re not making rookie mistakes)

✅ One critical constraint: bandwidth

That last point is crucial. The 40% isn’t hiding in “better” segmentation or “more compelling” copy. Your team already knows those fundamentals. The growth is hiding in the campaigns you’re not launching because you don’t have time, the high-intent moments you’re missing because you can’t analyze 2 million daily behavioral signals, and the budget you’re wasting on underperformers because monthly reviews happen too late.

We have proof from two companies in different industries — fintech and food delivery — both hitting 40%+ revenue growth in 90 days using the same approach. We’ll walk you through the primary case study (a European neobank) in detail, then show you how a food delivery platform achieved similar results by applying the same four revenue drivers.

If they can do it in regulated fintech and fast-paced food delivery, the pattern works across industries.

Before: A fintech app ran “okay” campaigns manually

Before ManyMoney AI, the neobank’s marketing team ran what most would consider solid campaigns:

- 9–12 campaigns per quarter across push notifications and emails, targeting loan applicants, new account openers, and dormant users

- Segmentation by demographics and account type (students, professionals, small businesses)

- Personalization based on name, account balance tier, and previously browsed products

- Scheduled sends at “best practice times” (Tuesday 10 AM, Thursday 2 PM)

- Manual A/B testing when bandwidth allowed (2–3 tests per quarter)

- Monthly performance reviews with the team to identify underperforming campaigns

The results:

- Loan application conversion rate: 2.1% (from engaged users who received campaigns)

- Average campaign creation time: 6–8 hours (compliance review, creative approval, segment building)

- Time to identify underperformers: 14–21 days (monthly review cycle)

- Quarterly revenue from engagement campaigns: €660,000

The hidden constraint:

The marketing team wasn’t lacking skill or tools — they had a solid CDP, full event tracking, experienced marketers, and a testing budget.

Yet, they couldn’t analyze 2.3 million daily behavioral signals, spot micro-patterns indicating loan intent 72 hours in advance, and launch 27 campaigns in 90 days while maintaining compliance standards.

That’s not a people problem — that’s a physics problem. Humans work 40 hours per week, while AI works 168.

After: 43% revenue growth thanks to 5 revenue drivers

- 27 campaigns per quarter (x3), optimized and scaled/stopped in real time

- Quarterly revenue from engagement campaigns: €945,000 (+43%)

Revenue driver #1: Campaign velocity (+15%)

The constraint: Manual campaign creation = 9 campaigns per quarter

In regulated fintech, every campaign requires compliance review, legal approval, brand sign-off, and technical QA, averaging 6–8 hours per campaign.

What ManyMoney AI did:

Compressed the campaign creation time to 20 minutes by:

- Storing pre-approved messaging templates with compliant language

- Auto-generating campaigns from natural language prompts: “Create a personal loan campaign for users who viewed rates 3+ times this week”

- Building customer journeys with conditional logic in a single conversation

- Handling technical setup (deep links, tracking parameters, segmentation rules) automatically

The result:

| Before | After | Impact |

|---|---|---|

| 9 campaigns in 90 days | 27 campaigns in 90 days | 3x more campaigns = 3x more opportunities for conversion |

Going from 9 to 27 campaigns created the capacity for more revenue, which was then filled with better targeting (Driver #2), optimization (Driver #3), and omnichannel journey design (Driver #5).

Revenue driver #2: Predictive high-intent targeting (+12%)

The constraint: Segmenting by past behavior misses users showing current intent

Traditional segmentation (e.g., users who clicked “Personal loans” in the past 30 days) captures users who were interested but misses those about to apply right now.

What ManyMoney AI did:

Analyzed 2.3 million behavioral events per day and identified 14 micro-signals that predicted loan applications 48–72 hours in advance, including:

| High-intent signal | Conversion probability |

|---|---|

| Viewed the loan calculator 3+ times in 72 hours | 67% |

| Compared personal loan vs. credit card rates | 54% |

| Browsed competitor rate comparison sites (tracked via an attribution partner), then returned to the app | 81% |

🔥 ManyMoney’s autonomous action:

“Found 347 high-intent loan shoppers showing application signals. Launching a push notification campaign now.”

The result:

| Before | After | Impact |

|---|---|---|

| 9 campaigns total in 90 days (all broad segments) Average: 20,000 users per campaign, 2.1% conversion Total: 9 × 420 = 3,780 applications | 27 campaigns total in 90 days (18 high-intent + 9 optimized broad campaigns launched before) High-intent campaigns: 347 users, 11.8% conversion = 41 × 18 = 738 applications Optimized broad campaigns: 18,000 users, 2.4% conversion = 432 × 9 = 3,888 applications Total: 738 + 3,888 = 4,626 applications | +22% = +108 applications from targeting alone |

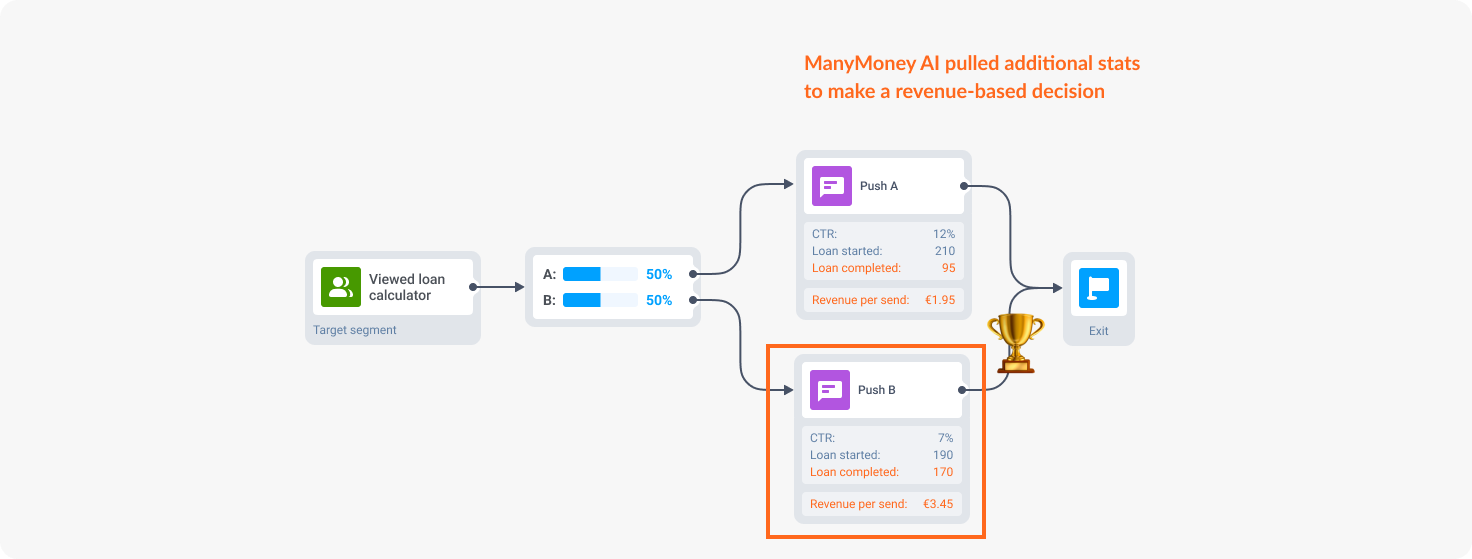

Revenue driver #3: Revenue-obsessed optimization (+10%)

The constraint: Optimizing for engagement metrics ≠ optimizing for revenue

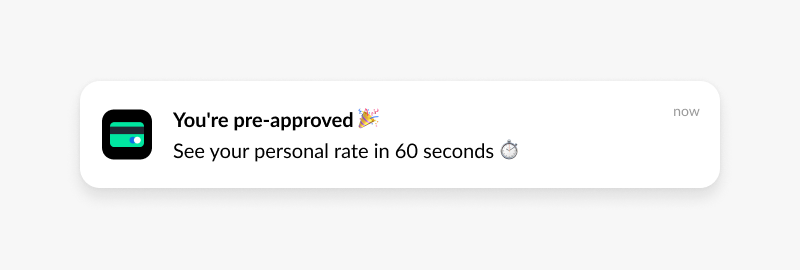

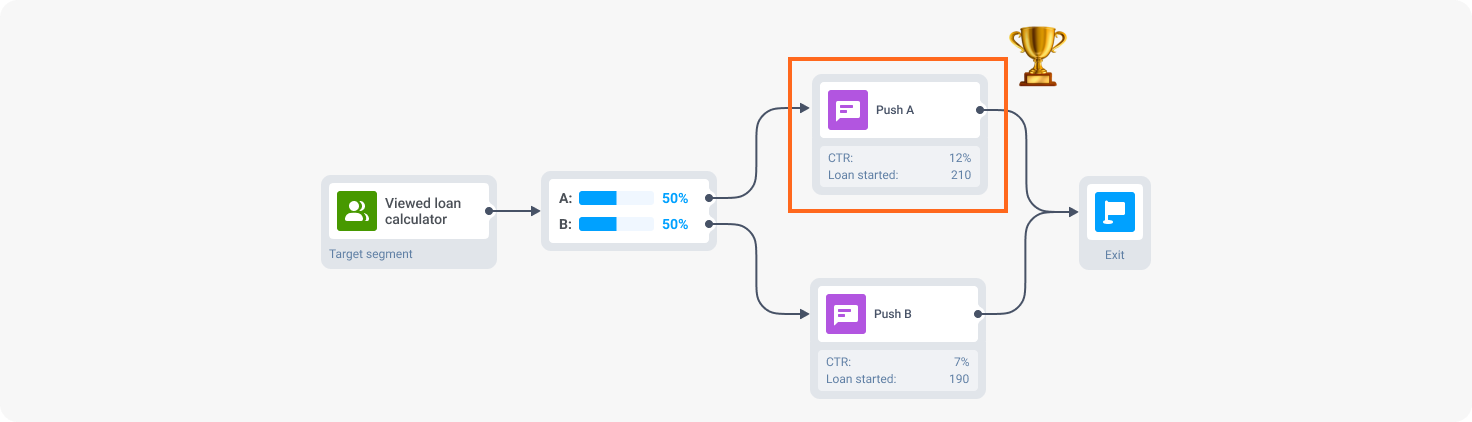

👨💻 The trap most fintech marketers fall into: after A/B testing, they scale the variant showing higher engagement and more target actions, like the example below:

🔥 ManyMoney’s decision, on the other hand, is based on a broader set of data with a focus on revenue. The AI sees that although more loans were started after campaign A, more loans were completed = more revenue gained after campaign B.

What ManyMoney AI did:

Ran 47 A/B tests simultaneously over 90 days, trying out:

- Message copy variations: “You’re pre-approved” vs. “See your rate” vs. “Compare our rates”

- Discount depth: No discount vs. €50 application bonus vs. 0.5% rate reduction

- Send time per user: Not “best time for segment” but “best time for this user”

- Deep link destinations: Home vs. loan calculator vs. pre-filled application

- Visual elements: Rich notification with rate preview vs. text-only

Killed underperformers within 48 hours and reallocated the budget to the winners.

The result: Continuous improvement across all 27 campaigns, contributing to the overall 43% revenue growth

Revenue driver #4: Autonomous performance management (+8%)

The constraint: Underperforming campaigns waste budget for weeks before the monthly review

What ManyMoney AI did:

- Killed 8 campaigns within 24-48 hours

- Scaled 11 campaigns 2–3x based on revenue performance

- Spent €0 on campaigns running longer than 48 hours without a positive ROI

| Metric | Stopped campaign | Scaled campaign |

|---|---|---|

| Campaign | Re-engaging dormant users (60+ days inactive in the app) via SMS (experiment) | Re-engaging a high-intent user segment via push |

| Speed advantage | ManyMoney AI did it within 18 hours. Human marketers would do it at a monthly review. | ManyMoney AI did it within 12 hours. Human marketers would do it at a monthly review. |

| Impact | Budget saved: €4,200 in SMS costs that would have been wasted in the remaining 29 days of the initially planned campaign | Revenue earned: €31,000 in the first week after scaling immediately |

The result: Real-time optimization prevented waste and captured opportunities up to 40x faster than monthly review cycles.

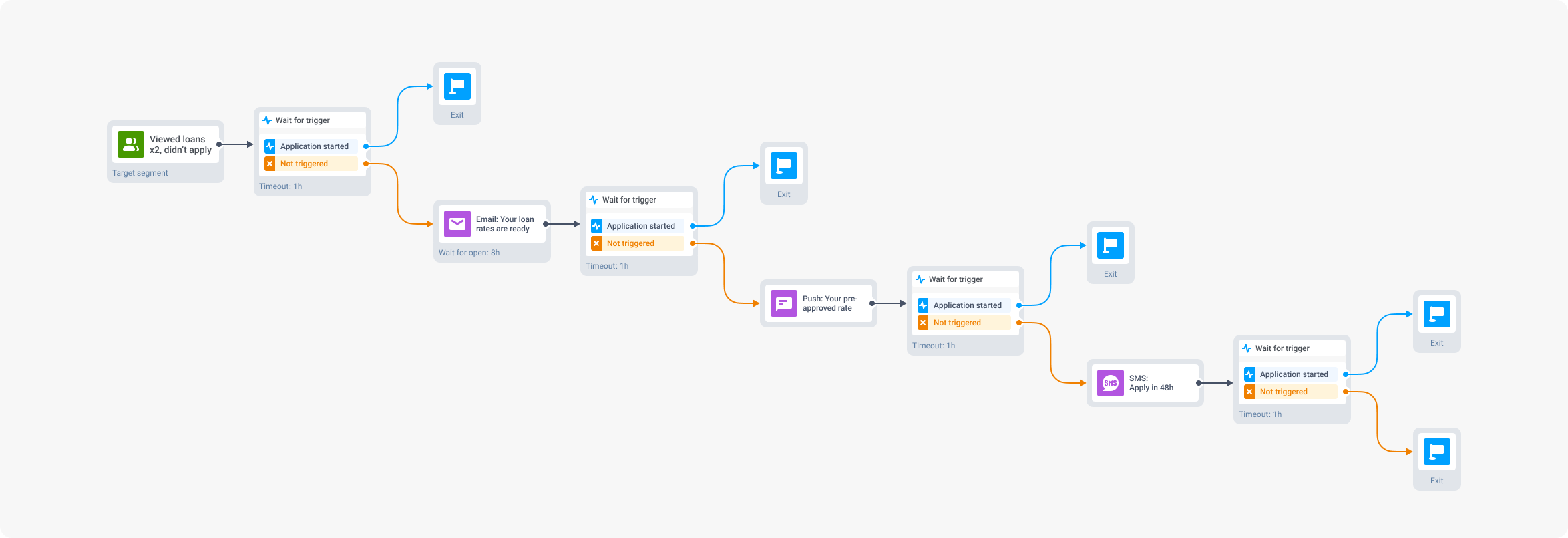

Revenue driver #5: Omnichannel journey sophistication (+10%)

The constraint: Single-message campaigns miss users who need multiple touchpoints

Traditional approach: Send one “Apply for a personal loan” push notification. If they don’t convert, wait 30 days, try again.

What ManyMoney AI did:

Built a Loan Application Journey from a single prompt:

The result:

| Before | After | Impact |

|---|---|---|

| Single push reminder: 2.1% conversion | Multi-touch journey created by ManyMoney AI: 8.7% conversion | 4x conversion = 4x more loan applications from the same initial segment = €52,000 in additional loan revenue |

Why this isn’t typical “AI marketing”

Most AI tools suggest: “Create a segment of users who viewed loan products 3+ times.” Then wait for humans to build it, launch it, and monitor it.

ManyMoney AI acts: “Found 347 high-intent loan shoppers. Launching campaign now.”

One is an assistant. ManyMoney AI is autonomous. That’s why it makes 43% growth possible.

Is 40% revenue growth realistic for your app?

The neobank’s 43% revenue growth isn’t an outlier. Another user of ManyMoney AI, a food delivery platform, achieved 47% in the same timeframe using the same approach.

Case study #2: Food delivery (+47% revenue)

Before ManyMoney AI:

- 10 campaigns per quarter (manual creation)

- Generic timing (lunch: 11:30 AM, dinner: 6 PM for everyone)

- Broad segments (ordered pizza before, vegetarian preferences)

- Average order value: $32

- Conversion rate on promotional pushes: 1.8%

- Quarterly revenue from engagement campaigns: $964,000

The constraint: The team knew better moments existed to reach each user, but manually identifying those moments for 80,000 users? Impossible.

What ManyMoney AI delivered:

- 28 campaigns per quarter

- Average order value: $41

- Conversion rate: 2.8% (weighted average of high-hunger 4.2% + optimized campaigns)

- Quarterly revenue from engagement campaigns: $1,417,000 (+47%, or +$453,000)

| Focus area | ManyMoney's action | Result |

|---|---|---|

| Campaign velocity | Replaced 10 manually created campaigns with 28 campaigns auto-generated from prompts | $3,200 generated from one campaign ×18 additional campaigns created by ManyMoney = $90,000 of incremental revenue |

| Predictive targeting | Identified "high-hunger moments" by app opens without orders, time since last order, weather patterns, and paycheck timing | 1.8% → 4.2% conversion, $32 → $41 AOV |

| Revenue optimization | Killed campaigns with high CTR but low AOV, e.g., "🍕 20% off pizzas!" | 1.6% → 3.1% conversion, $28 → $38 AOV |

| Performance management | Killed campaigns with the negative margin, e.g., "$2 off any order" that brought many clicks and only $12 salads | $8,500 saved from unprofitable discounts |

| Journey sophistication | Replaced one-off abandoned cart reminders with multi-touch sequences via push → email → SMS | $42,000 in recovered orders quarterly |

You’ll see 40%+ revenue growth if…

✅ You’ve already got “okay” campaigns (not terrible, not sophisticated)

✅ Conversions/transactions in your app are high-value, even though not that numerous

✅ Event tracking is solid (AI has data to learn from)

✅ You are bandwidth-constrained (more campaigns = more revenue, but your team physically has no time)

✅ Your team knows how to optimize campaigns for engagement, but not revenue

How to prove the revenue growth from using ManyMoney AI

☝️ Remember to isolate ManyMoney AI’s impact from everything else:

Option 1: A/B test approach (strongest proof)

- Split users into two groups: 50% get ManyMoney AI campaigns, 50% get standard campaigns

- Compare revenue per user between groups

- This proves causation, not just correlation

Option 2: Before/after with controls

- Compare the revenue growth rate before vs. after ManyMoney AI

- Account for: seasonality, overall user growth, external campaigns

- If your app grew 10% organically but 50% total after ManyMoney AI, the tool drove a 40% incremental lift

Option 3: Channel-specific attribution

- Isolate revenue from ManyMoney AI-powered channels (push, email, in-app)

- Compare conversion rates and revenue per message before/after

- Calculate the incremental revenue generated

The 40% guarantee

We’re so confident that ManyMoney AI will deliver 40%+ revenue growth that we offer a full refund guarantee.

This guarantee applies whether you’re a:

- Fintech app converting high-value customers (like our neobank example: +43%)

- Transactional app driving frequent purchases (like our food delivery platform: +47%)

- Gaming app increasing IAP revenue

- E-commerce app recovering abandoned carts

The guarantee is the same: if you don’t see at least a 40% increase in revenue from engagement channels within 90 days, we refund your investment. No questions asked.