Fintech push notifications: Benchmarks, best practices, and real examples

Fintech users may not open your app daily, but they do want timely, relevant updates, especially when it comes to their money. The challenge is to find the balance between customer engagement and trust, without overwhelming users.

To uncover what really works, Pushwoosh analyzed 500k push notifications, including over 155k sent by finance apps.

In this post, you’ll get a clear, actionable push notification strategy for fintech, backed by data and examples from leading apps.

2025 fintech push notification benchmarks & trends

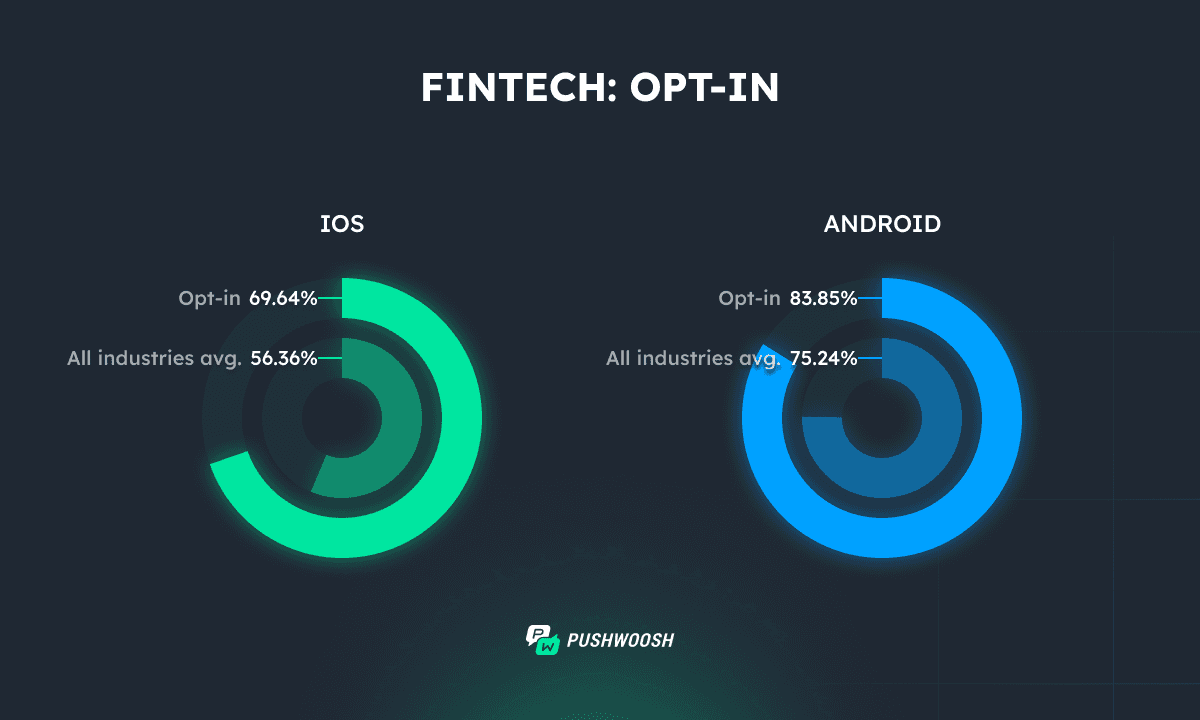

Pushwoosh’s 2025 study reveals that finance apps lead all industries in push opt-in rates, outperforming benchmarks on both iOS and Android. This gives fintech apps a strong foundation: your users want to receive notifications.

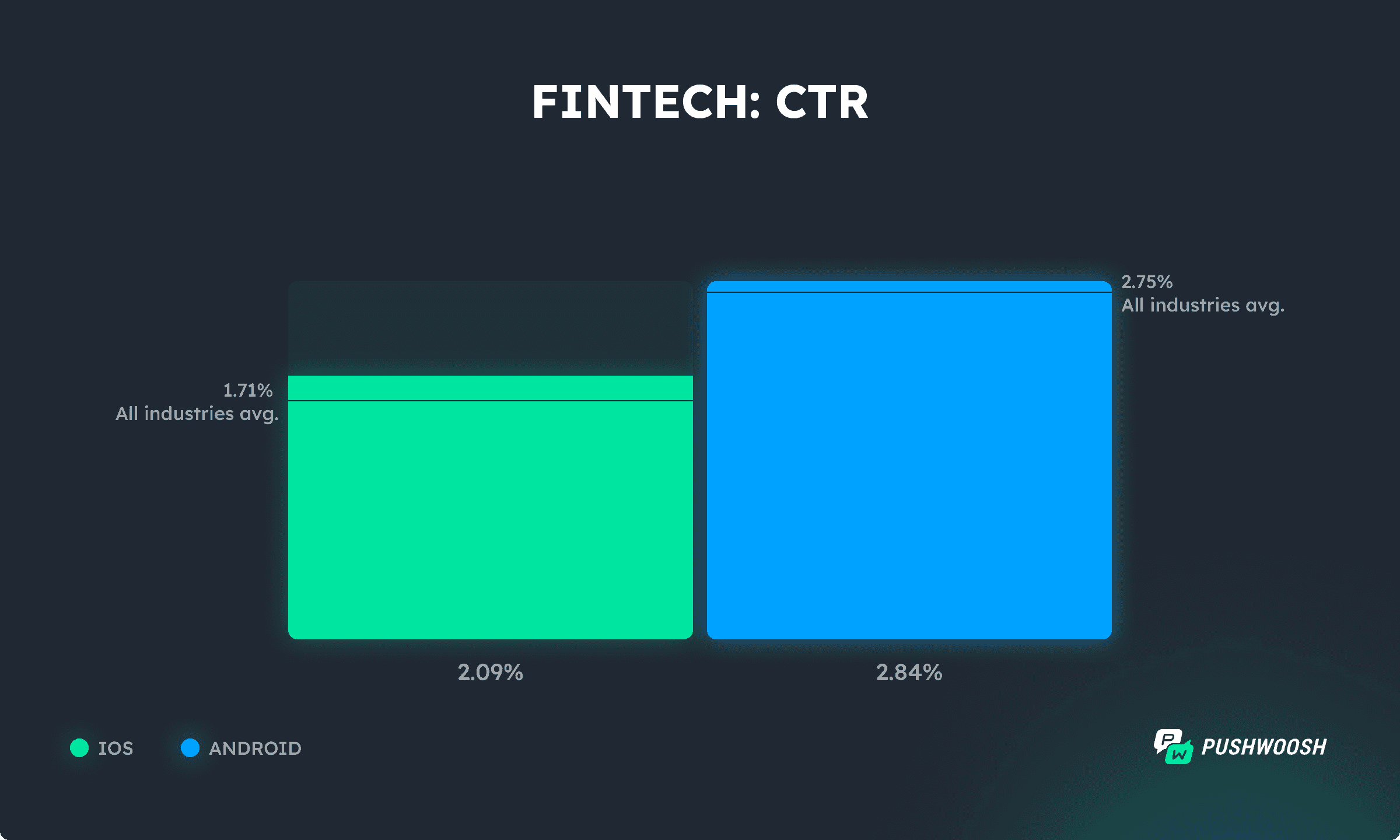

Finance apps also show strong CTRs, with both iOS and Android performing slightly above the all-industry benchmarks.

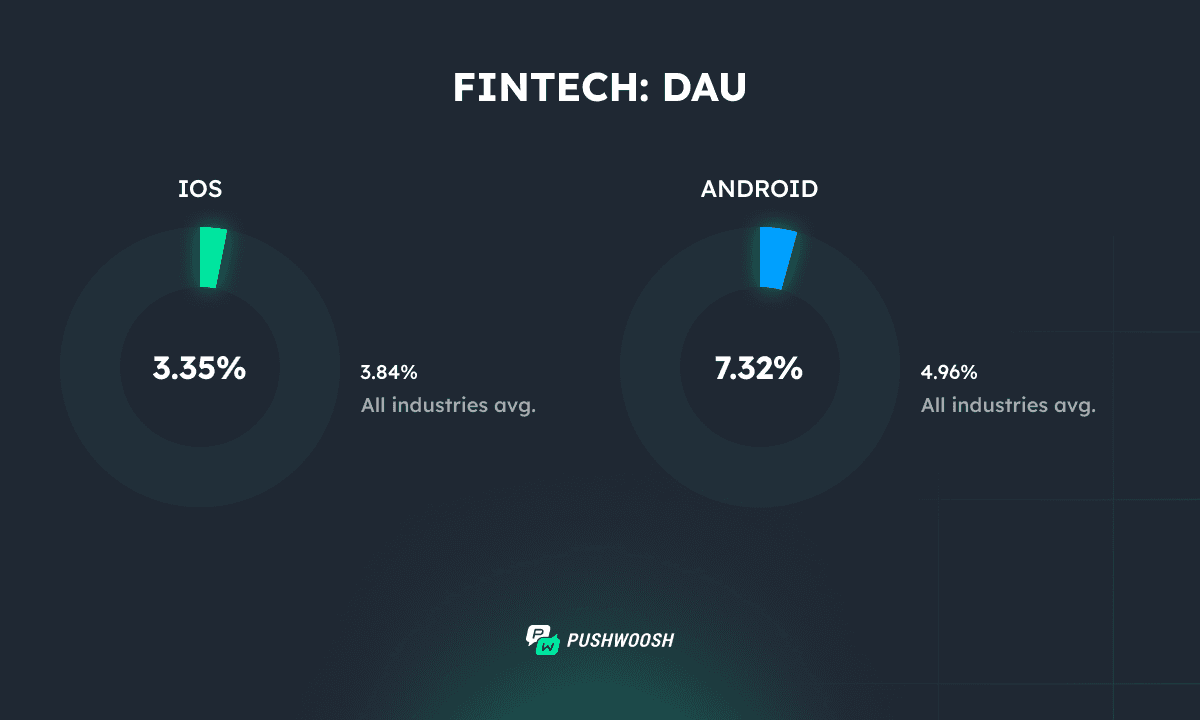

When looking at daily and monthly activity, the trend is clear: DAU on iOS is just below the industry average, while Android outperforms.

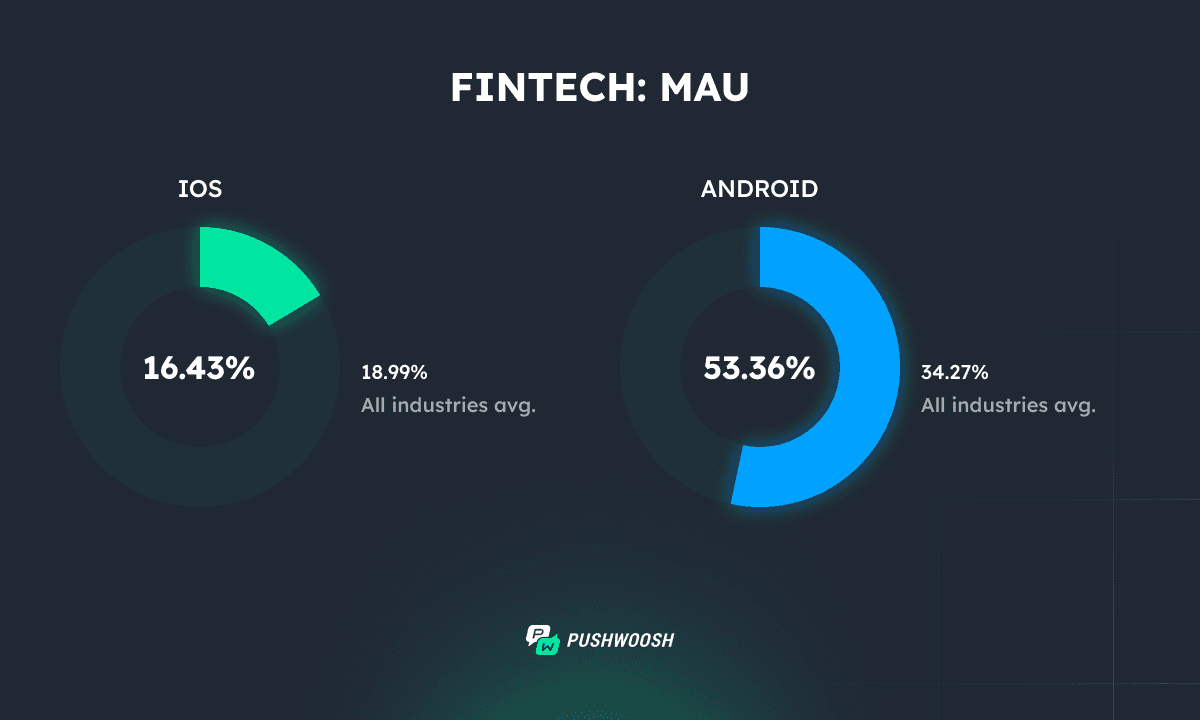

MAU follows a similar pattern, showing that Android users interact with fintech apps more frequently and consistently.

💡 Takeaway:

Fintech users are ready to engage, but not with daily blasts.

You need to meet them with the right message at the right time in their lifecycle.

Let’s explore push notification best practices that will help you implement these insights and increase engagement.

The golden rule of fintech — stop broadcasting, start segmenting users

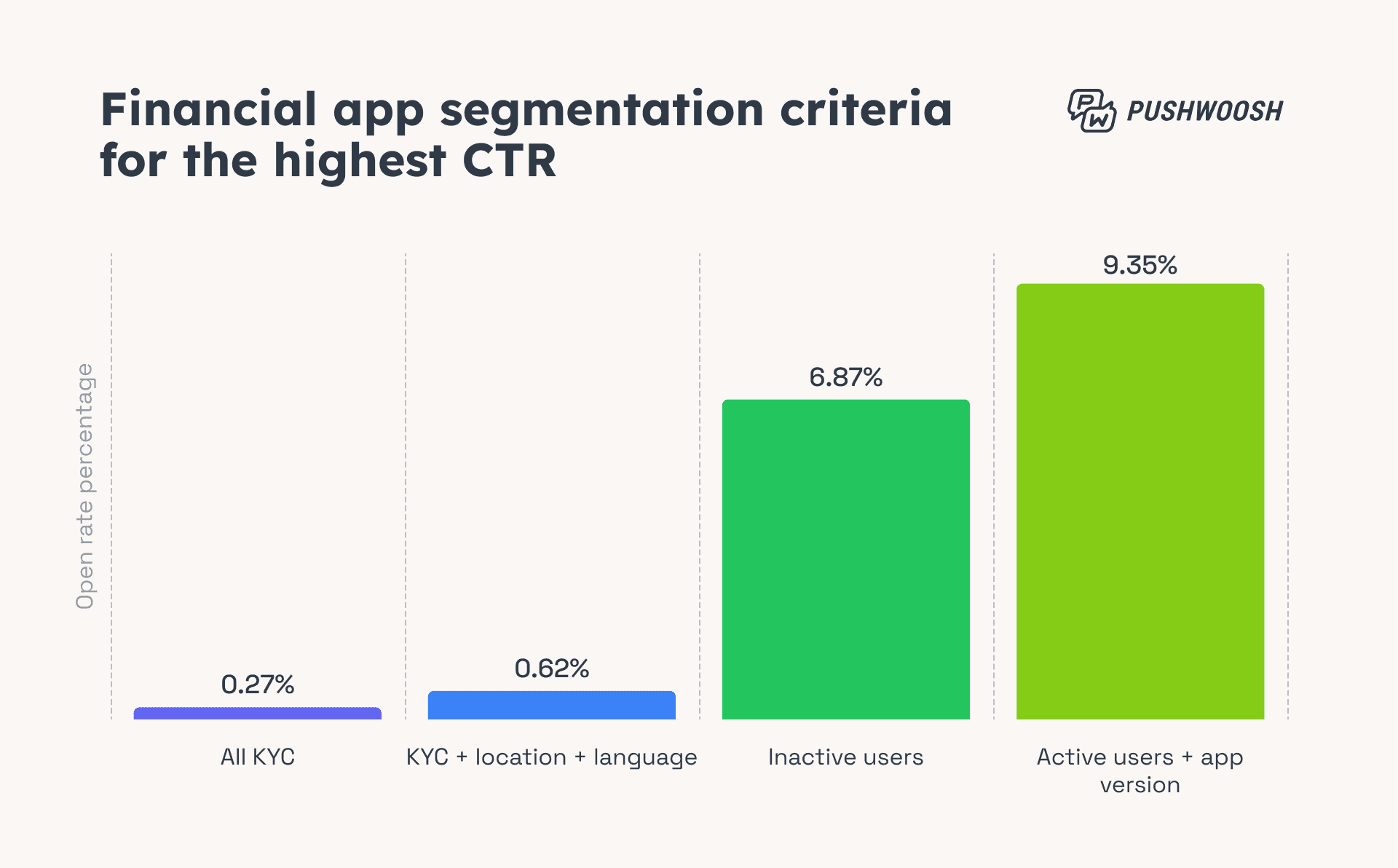

One thing stood out clearly in our data: fintech apps don’t blast messages to all users.

Why? Because segmentation works.

Pushwoosh’s previous research, reinforced by this 155k dataset analysis, shows that narrow segmentation can dramatically boost CTRs — up to 9.35%, which is over 14x the fintech’s average.

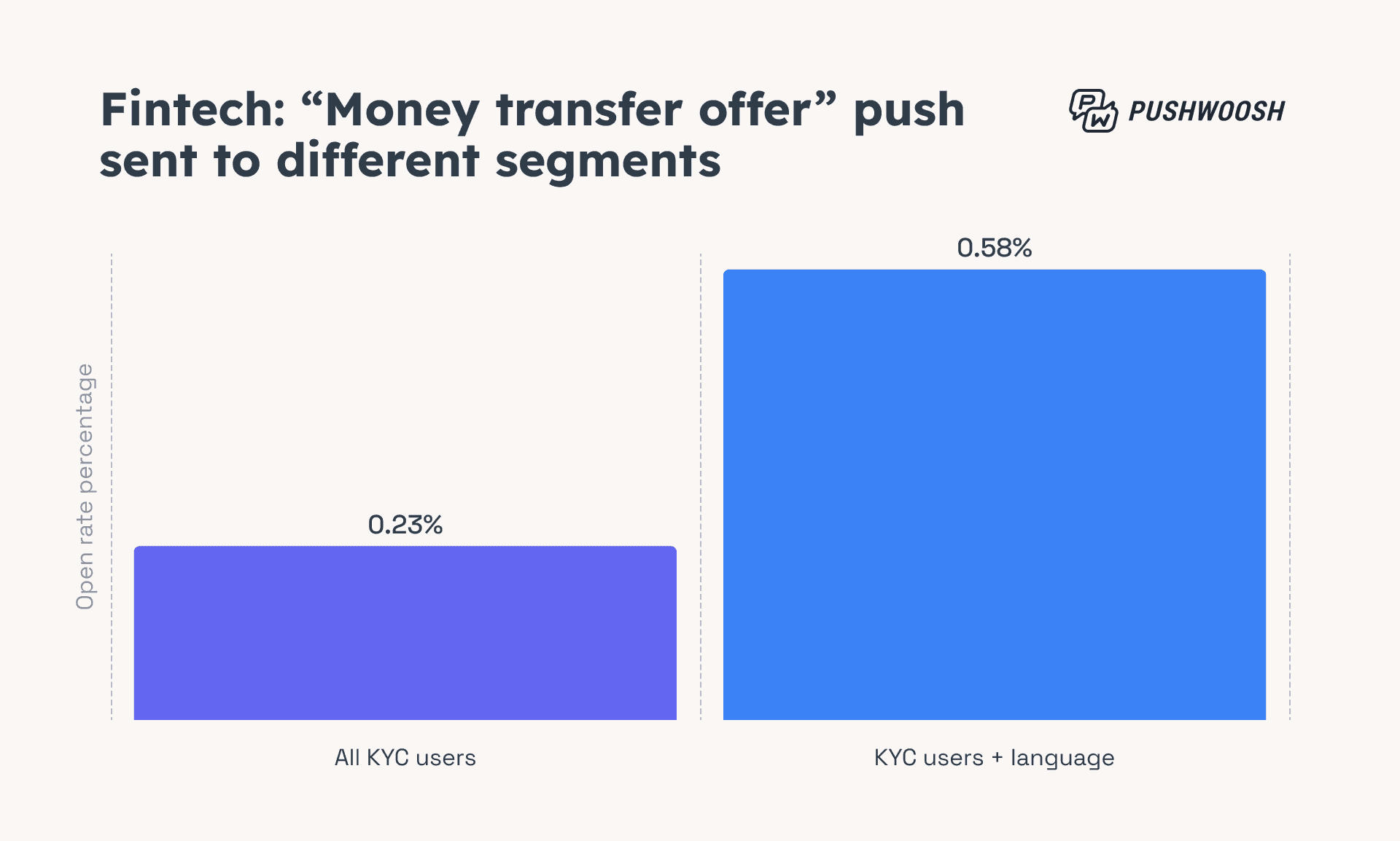

The same message content, when sent to different user segments, performs very differently.

For example, users who invested time into setting up their account preferences, like completing KYC, choosing their city or language, show higher CTRs than users who hadn’t.

➡️ Strategy: To get better push notification performance, segment users by:

- Attributes (Tags): KYC status, language, account type, region

- Behavior (Events): deposits made, features used, last login, trade executed

Then reach out with hyper-personalized messages that reflect each user’s behavior and preferences, not a one-size-fits-all blast.

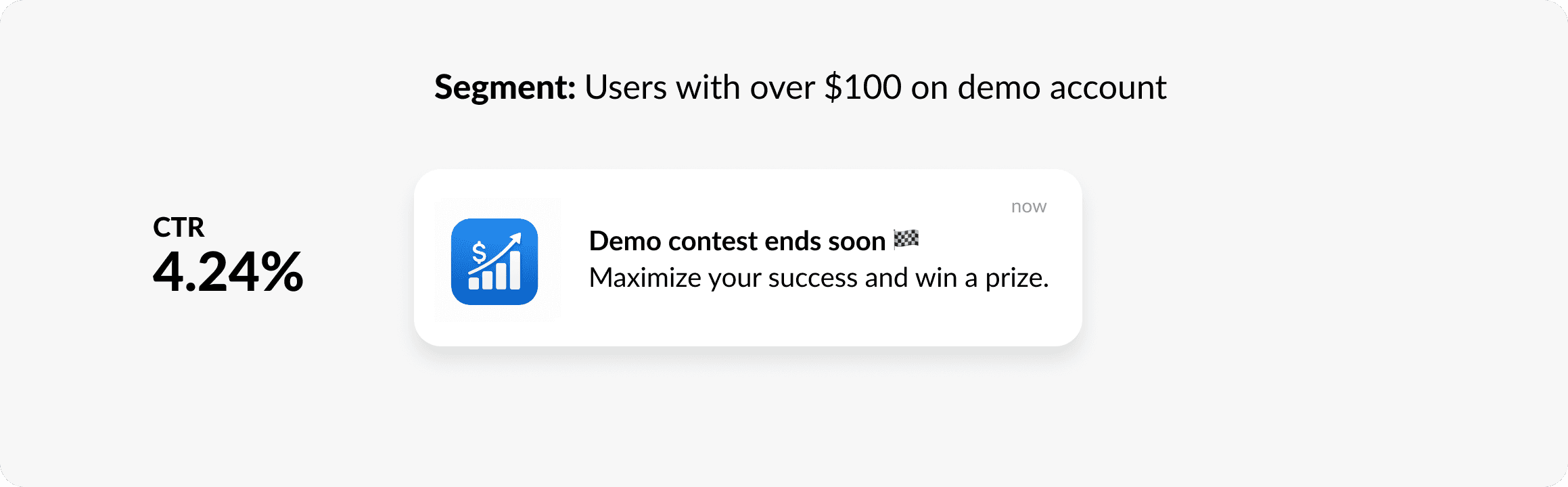

For example, one trading app targets users with a demo account balance of over $100 and sends them a message with an invitation to join a demo contest.

2x CTR with personalized push notifications

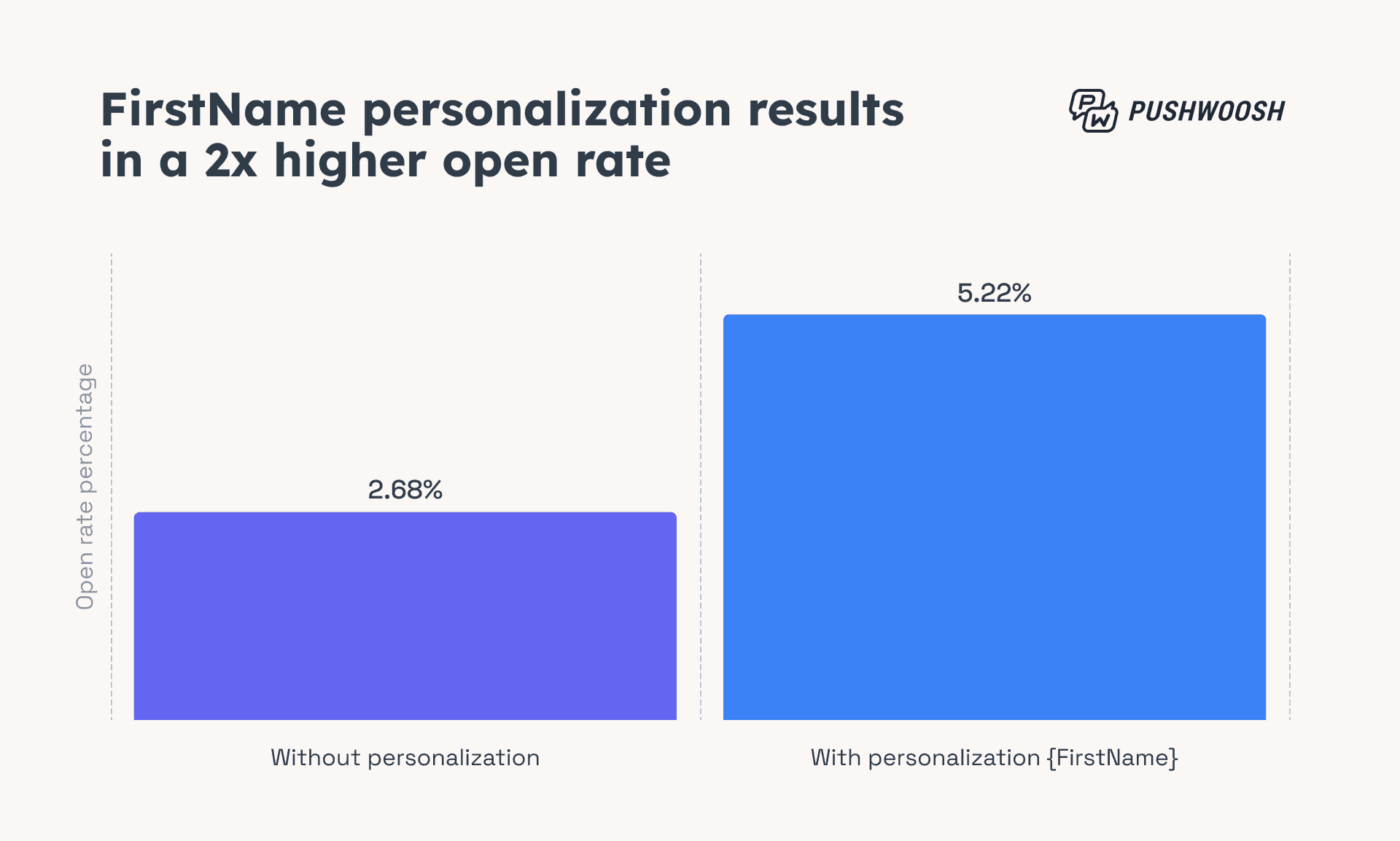

Personalized push content makes a big difference; even a small tweak pays off.

For example, messages that include a user’s first name generate twice the click-through rate compared to generic ones.

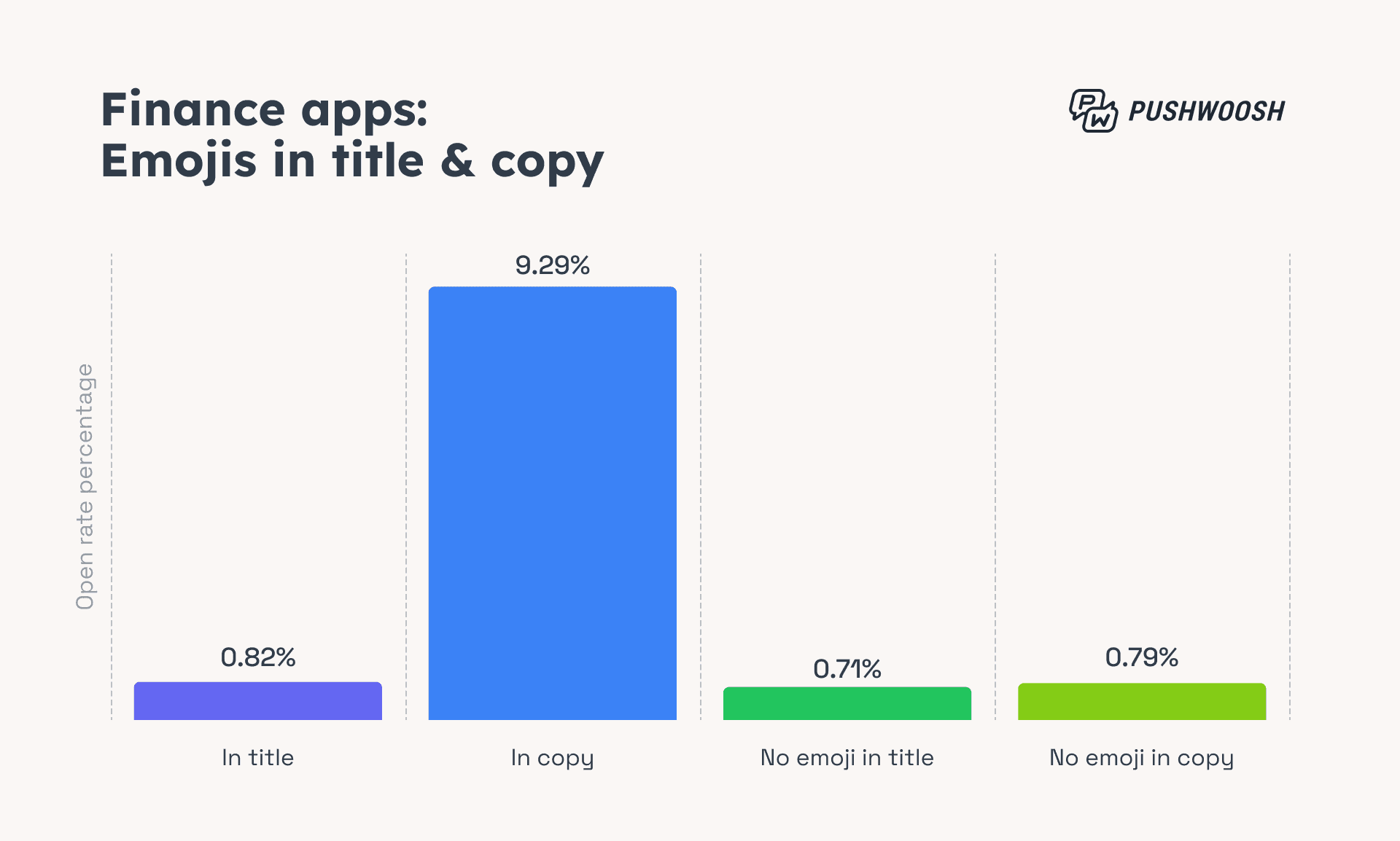

Another quick win? Use emojis in the message body, not the title — that’s where they actually boost open rates.

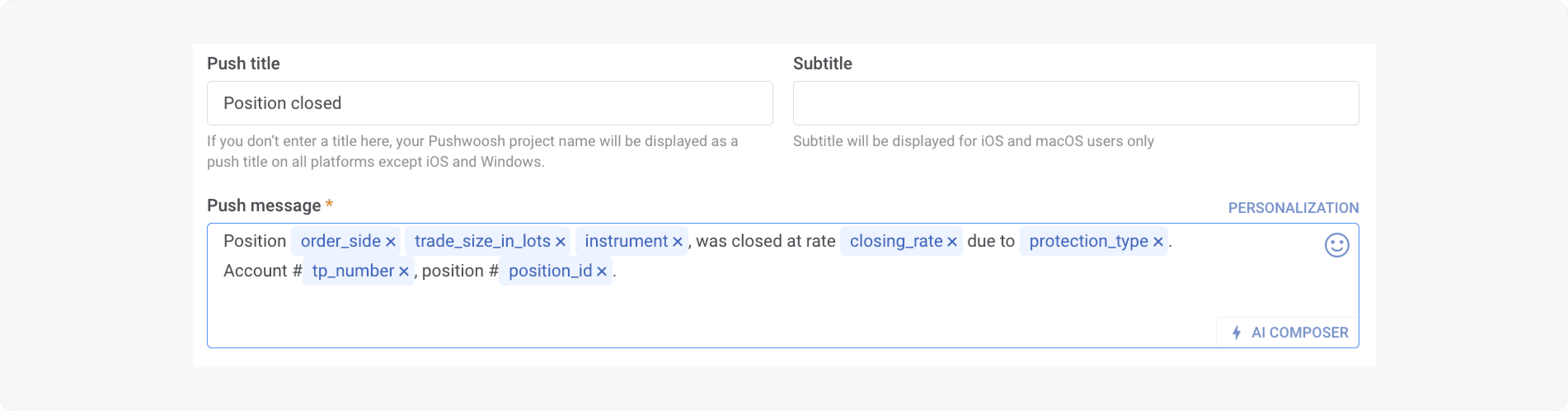

The deep personalization strategy worked out great for AvaTrade, whose messages with dynamic content achieved a CTR 9.4x higher than the industry average.

🔥Pro tip: Validate your message content variations with Pushwoosh’s A/B/n testing to find what really drives customer engagement.

Lifecycle messaging: 5 examples using triggers

Forget blanket promotions. The most effective fintech push notifications are helpful, timely, and tailored.

Align each message with a user’s real actions or needs, and send it when they’re most likely to engage & convert.

➡️ Strategy: Use real-time triggers or API-based entry to react immediately to certain in-app events and guide users toward key actions. This minimizes users from disabling notifications and improves the customer experience.

Below are real-world examples of customer flows automated with Pushwoosh’s Customer Journey Builder:

Recommend products or features

Trigger: User exceeds spending limit

Action: Recommend enabling the budget tracking feature

Result: Increased product adoption

.png)

Encourage repeated usage

Trigger: First bill paid

Action: Prompt to enable autopay

Result: More recurring transactions

.png)

Trading signal alerts

Trigger: A new trading signal (e.g., moving average crossover) is detected that matches the user’s preferred strategy via API

Action: Send a real-time alert to take an action

Result: Boost in app opens and trading activity

.1.png)

Re-activate dormant users

Trigger: No app activity for 14+ days

Action: Send a personalized incentive or helpful reminder

Result: Higher reactivation rates

.1.png)

Send security alerts

Trigger: Suspicious login attempt or password change

Action: Send a real-time security alert

Result: Increased trust, reduced churn risk

.1.png)

🛡️ Pushwoosh processes data on servers in the US and Germany, with guaranteed GDPR compliance for European customers.

More channels = more reach (and conversions)

Even with strong push notification performance, not every user can be reached through push alone. Channels like in-app messaging, email, SMS, and WhatsApp play a unique role at different stages of the customer engagement journey — from welcoming new users to re-engagement of dormant ones.

➡️ Strategy: Use an all-in-one engagement platform to combine push notifications with other channels and maximize retention and app usage.

This omnichannel approach ensures you’re delivering timely and relevant information to each user, without overwhelming them.

For example, a South African fintech startup increased its user base and scaled communication from 1M to 8M emails over a month by combining push notifications and emails — all managed through Pushwoosh’s omnichannel platform.

AvaTrade also adopted this strategy, combining web and mobile push notifications with in-app messaging, and achieved a 12% boost in conversion rates to account registrations.

🔥Pro tip: Try Pushwoosh’s Reachability check feature to identify which channels users are reachable on, and follow up through the most effective one to scale reach.

Pushwoosh: Reliable customer engagement platform for fintech

When it comes to engaging fintech users, success depends on delivering the right personalized message, at the right time, without compromising trust or compliance, or exposing sensitive information.

With all channels managed on a single platform, Pushwoosh helps finance apps drive engagement, product adoption, and long-term value.